Living in, working in, or owning a property in France all require you to have insurance of at least one sort, and possibly several variations from property to car, civil liability to health and more besides. We ask Brittany based Tom Furnival at leading insurance company RSR Assurances to explain all about French insurance. RSR Assurance, who celebrate 70 years of excellent service in 2024, cover all aspects of French insurance to help people all over France, and offer support for English speakers for all their insurance needs and to help to ensure that compulsory French insurance requirements are met.

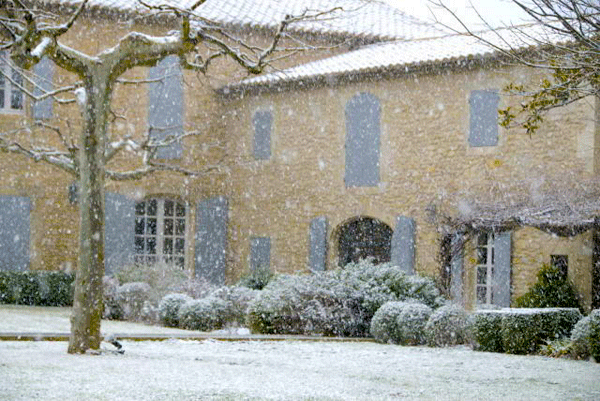

Property Insurance in France

When you buy or own a property in France, it’s a legal requirement to have insurance and that must include what’s called ‘responsibilite civil’, which covers damage caused by a third party. There are different types of insurance for homeowners, holiday homeowners, renters, and – if you’re buying a home in France, you’ll need to have insurance organised for the day you take ownership.

Home insurance will cover the building, public liability, contents and construction insurance. Prices cover a wide range, depending on property value, age, size, type of cover, number of outbuildings etc. Some policies will require you to install shutters, new locks or alarms. It can be quite confusing if you’re not used to the French way of insurance, it’s important to understand what’s being offered, and what’s in the small print. If you’re unsure, Tom is happy to help English speakers understand what the best insurance is for each situation.

There’s also construction insurance which is usually a separate policy to cover major works to your property.

Health Insurance in France

French health insurance can seem pretty complicated, especially for British expats used to the NHS. France has one of the best health care systems in the world and operates under a system of public health care which is free to all legal residents – but some treatments carry additional costs. For instance, a GP appointment for an adult will cost from €25 of which 70% will be reimbursed by the state via the Carte Vitale system. The fee for a consultation varies according to the type of consultant required. Some medicines have a cost not covered by public health care. So, in France it’s common to have complementary health insurance – called a mutuelle, a top up insurance which gives you a higher (or total) level of reimbursement and can cover you for ‘extras’ such as dental treatment, glasses and contact lenses, medicine, a private room in hospital, transport for medical treatment and a raft of other things. Around 95% of French people take out a form of health insurance which is available to all and does not take into account pre-existing health conditions.

In some circumstances, a top-up health insurance policy is mandatory, for instance salaried employees who will have a minimum of 50% of the cost covered by their employers. Microentrepreneurs require their own independent mutuelle.

Tom says that “with RSR, you’ll have one point of contact for your health insurance needs, and we will help with the paperwork should you need to make a claim.”

Car insurance in France

Not surprisingly, motor insurance is obligatory in France. You must insure all motor vehicles in France including cars, motorbikes, quad bikes, tractors, caravans, trailers and even ride on lawn mowers. Even if a car is not in use – unless all four wheels are removed – it must be insured (unlike in the UK when you declare that a car is SORN, off the road). Policies are either third-party (tiers collision), third-party fire and theft, or comprehensive (tous risques). You can include caravans and trailers on your car insurance policy – unless the weight is over 750kg in which case you’ll need to have separate cover.

Holiday or second home insurance in France

Many insurers require that you fulfil certain obligations for holiday or second home insurance. This could include the maximum number of days you can leave the property empty, security systems being installed, additional locks and shutters etc. And if you’re renting out your holiday home, then you’ll also need to look at public liability insurance.

Business and professional insurance

There are different types to suit different businesses – running a gite, bar, restaurant etc. Tom’s advice is to speak to your insurance adviser and get professional advice to make sure you’re covered properly.

Travel insurance in France

If you’re in the French healthcare system then you are entitled to an EHIC (European Health Insurance Card), or Carte Européenne d’Assurance Maladie (CEAM), which covers you for treatment within Europe but if you want travel insurance outside of Europe, you’ll need to take out a policy.

Life insurance in France

Known as ‘assurance décès’ – death insurance – life insurance policies are mandatory if you take out a French mortgage or bank loan. ‘Assurances vie’ – life insurance – is actually a savings vehicle and nothing to do with life insurance!

School insurance

In France, all students must have school/university insurance that covers them for damage they may cause to the school or people at school. It’s often covered by the home insurance policy and is obligatory for out of school trips and extracurricular sports.

Pet Insurance

Whilst it’s not unusual to have cover for your beloved pet in some countries, it’s not really that common in France but insurance is available to cover cost of medical treatment.

The best French insurance services

Although RSR Assurance mainly use GAN Insurance products (one of the leading insurance providers in France), they are also brokers, and will compare products to ensure the best deals and solutions and deal with all claims on your behalf, you’re not passed on to someone else when you most need help from a trusted source. They offer free quotations for all insurance services throughout France.

Get a free quote for all your French insurance needs at: agence.gan.fr

Contact Tom Furnival at: contact@rsr-assurances.bzh